Oracle Assets is an Asset Management solution which helps you maintain the assets accurately with best accounting and tax strategies.

What you can do in Oracle Asset Management system?

1. Add, Adjust, Depreciate and Retire the Assets

2. Maintain Tax books to comply with Local law/Tax bodies

3. Generate Accurate accounting

4. Online Inquiries which helps you know the asset information world wide from a single place.

5. generate reports of complete Asset transactions to make sure that the asset inventory is accurate.

What is the criteria to create an Asset?

A fixed asset is an asset with useful life, generally greater than one reporting period, and which exceeds an entity's minimum capitalization limit.

How the Assets are setup in Oracle Asset Management?

Assets are assigned to a category and then to Asset Book. So Asset Categories and Asset Books need to be created before creating the assets in system.

Asset Category:

Asset Categories group assets that share same accounts and depreciation rules. System used these values as default while entering the asses.

The Asset Categories form is comprised of three sections.

1. Header Section: Contains general information of Asset Category. This remains same regardless of the Asset Book attached to the category.

2. General Ledger Accounts Section: This sections allows you to assign an Asset Book which contains the default General ledger accounts. You can assign multiple Asset Books to an Asset Category.

3. Default Depreciation Rules Section: Set up default depreciation rules for each asset book assigned to the category. You can override these default values in Asset Workbench.

Asset Book:

Asset Books store financial information for a group of assets. Below are the 3 types of Asset Books.

1. Corporate Book : Maintain Financial information for your Balance Sheet. Each Corporate Book can have multiple Tax books assigned.

2. Tax Book: Maintain Financial information for your tax authorities

3. Budget Book: Maintain planned capital expenditures.

You need to define Corporate book first and then the Tax and Budget books.

Prerequisites to define an Asset Book:

1. Setup System Controls

2. Define Asset Calendars

3. Setup Account segment values and combinations

4. Setup Journal Sources and Categories

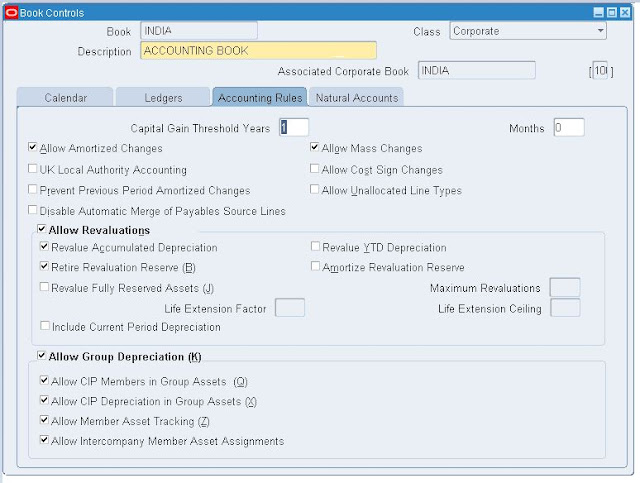

defining an Asset Book has four sections - Calendar, Ledgers, Accounting Rules, Natural Accounts. You need to assign all these to your Asset Book to complete the Asset Book definition.

What are the other important setups?

1.System Controls:

System Controls are setup only once per installation. Use System Controls to specify your Enterprise name, Asset Numbering sequence and Key flexfield structures.

- The Enterprise name you specify here will be used on all Oracle reports.

- You can not place the assets in Service before the Oldest date Placed in Service you specify here. It control what date to begin your calendars.

- You cannot update the Oldest Date Placed in Service, once the calendars are assigned to Depreciation books.

- You cannot update the Key flexfield structures once saved.

- Starting Asset Number is the number system uses to populate the first asset in the system. The maximum asset number that Oracle supports is 2,000,000,000.

- If you are converting the assets from another system, it is important to use the starting asset number greater than the no. of assets you want to convert to populate the same asset numbers from previous system.

2. Fiscal Years & Calendars:

Setup Fiscal Years by specifying the Start Date and End Date of each fiscal year.

- You need to create Fiscal Year from oldest Date Placed in Service through at least one fiscal year beyond the current fiscal year. Depreciation will fail if the current fiscal year is last fiscal year defined in the system.

- The Calendars assigned to the Corporate book and the associated Tax book must use the same Fiscal year name.

- You need to define Fiscal Years first before defining the calendars.

- At the end of each fiscal year, depreciation automatically generates the dates for Following Fiscal year and calendar.

Calendars: The Asset book requires a Depreciation calendar and a Prorate Calendar.

Depreciation Calendar: Determines the no. of accounting periods in a fiscal year.

Prorate Calendar: Determines the no. of prorate periods in a fiscal year.This is used to determine the prorate period that is used to select the annual depreciation rate.

- You can use one calendar as both Depreciation and Prorate Calendar for a book.

- The Calendars assigned to the Corporate book and the associated Tax book must use the same Fiscal year name.

- The Depreciation program uses the:

Prorate calendar to determine the Prorate Period which is used to select the Depreciation rate.

Depreciation Calendar to divide the depreciation flag to determine what fraction of annual depreciation expense to take each period.

Example:

Depreciation Calendar : Monthly

Depreciation calculation logic: The program calculates 1/12 of Annual Depreciation, each time you run the Depreciation program.

What you can do in Oracle Asset Management system?

1. Add, Adjust, Depreciate and Retire the Assets

2. Maintain Tax books to comply with Local law/Tax bodies

3. Generate Accurate accounting

4. Online Inquiries which helps you know the asset information world wide from a single place.

5. generate reports of complete Asset transactions to make sure that the asset inventory is accurate.

What is the criteria to create an Asset?

A fixed asset is an asset with useful life, generally greater than one reporting period, and which exceeds an entity's minimum capitalization limit.

How the Assets are setup in Oracle Asset Management?

Assets are assigned to a category and then to Asset Book. So Asset Categories and Asset Books need to be created before creating the assets in system.

Asset Category:

Asset Categories group assets that share same accounts and depreciation rules. System used these values as default while entering the asses.

The Asset Categories form is comprised of three sections.

1. Header Section: Contains general information of Asset Category. This remains same regardless of the Asset Book attached to the category.

2. General Ledger Accounts Section: This sections allows you to assign an Asset Book which contains the default General ledger accounts. You can assign multiple Asset Books to an Asset Category.

3. Default Depreciation Rules Section: Set up default depreciation rules for each asset book assigned to the category. You can override these default values in Asset Workbench.

Asset Book:

Asset Books store financial information for a group of assets. Below are the 3 types of Asset Books.

1. Corporate Book : Maintain Financial information for your Balance Sheet. Each Corporate Book can have multiple Tax books assigned.

2. Tax Book: Maintain Financial information for your tax authorities

3. Budget Book: Maintain planned capital expenditures.

You need to define Corporate book first and then the Tax and Budget books.

Prerequisites to define an Asset Book:

1. Setup System Controls

2. Define Asset Calendars

3. Setup Account segment values and combinations

4. Setup Journal Sources and Categories

defining an Asset Book has four sections - Calendar, Ledgers, Accounting Rules, Natural Accounts. You need to assign all these to your Asset Book to complete the Asset Book definition.

What are the other important setups?

1.System Controls:

System Controls are setup only once per installation. Use System Controls to specify your Enterprise name, Asset Numbering sequence and Key flexfield structures.

- The Enterprise name you specify here will be used on all Oracle reports.

- You can not place the assets in Service before the Oldest date Placed in Service you specify here. It control what date to begin your calendars.

- You cannot update the Oldest Date Placed in Service, once the calendars are assigned to Depreciation books.

- You cannot update the Key flexfield structures once saved.

- Starting Asset Number is the number system uses to populate the first asset in the system. The maximum asset number that Oracle supports is 2,000,000,000.

- If you are converting the assets from another system, it is important to use the starting asset number greater than the no. of assets you want to convert to populate the same asset numbers from previous system.

2. Fiscal Years & Calendars:

Setup Fiscal Years by specifying the Start Date and End Date of each fiscal year.

- You need to create Fiscal Year from oldest Date Placed in Service through at least one fiscal year beyond the current fiscal year. Depreciation will fail if the current fiscal year is last fiscal year defined in the system.

- The Calendars assigned to the Corporate book and the associated Tax book must use the same Fiscal year name.

- You need to define Fiscal Years first before defining the calendars.

- At the end of each fiscal year, depreciation automatically generates the dates for Following Fiscal year and calendar.

Calendars: The Asset book requires a Depreciation calendar and a Prorate Calendar.

Depreciation Calendar: Determines the no. of accounting periods in a fiscal year.

Prorate Calendar: Determines the no. of prorate periods in a fiscal year.This is used to determine the prorate period that is used to select the annual depreciation rate.

- The Calendars assigned to the Corporate book and the associated Tax book must use the same Fiscal year name.

- The Depreciation program uses the:

Prorate calendar to determine the Prorate Period which is used to select the Depreciation rate.

Depreciation Calendar to divide the depreciation flag to determine what fraction of annual depreciation expense to take each period.

Example:

Depreciation Calendar : Monthly

Depreciation calculation logic: The program calculates 1/12 of Annual Depreciation, each time you run the Depreciation program.